The annual report of London Heathrow Airport 2022 represents three types of revenue (ANNUAL REPORT, 2022):

- Aeronautical Revenue

- Retail Revenue

- Revenue from other sources

Aeronautical Revenue

The Annual report of London Heathrow accounts for £1879 Million in aeronautical revenue in the year 2022. Aeronautical revenue generally refers to the income generated by an airport from fees charged to airlines for using airport infrastructure, services, and facilities. London Heathrow Airport comprises three main aeronautical revenue sources including Passenger charges, movement charges, and parking charges.

Passenger Charges: Passenger charges are applied to the number of passengers embarked and disembarked on the aircraft for the flight. While Pilot and cabin crews travel free of cost in this case. Charges per passenger depend on the designated route. Such as travelers on domestic and common area flights are charged less as compared to Europe and other farther regions.

Movement Charges: Movement charges are imposed on airlines for each landing and takeoff at the airport. These charges come under aeronautical revenue because of the airport’s airside infrastructure and services used. Movement charges are calculated based on the maximum take-off weight of the aircraft, noise chapter rating, and time of the day (peak or off-peak time) selected for landing and take-off.

Parking charges: Parking charges are calculated for each 30-minute time slot (depending on whether the aircraft is narrow or wide-body)

Retail Revenue

The Annual Financial Report of London Heathrow Airport 2022 showed £564m of retail revenue. The various classifications of retail revenue include retail concessionaries, catering, Heathrow Express, property and other, car parking, and other regulated charges.

- Retail: Concessions generated £206m from advertising and selling premium products

- Catering: Catering accounts for £59m from lounges, restaurants and café

- Heathrow Express: The rail service of Heathrow Airport generated £2m

- Cark Parking: Car parking accounts for £143m, as it serves as a ground transportation need and is not related to airline operations.

- Property and other rental: Property and others accumulated £146m from renting out airport space for hangars, airline offices, maintenance stations, and warehouses.

Revenue from other sources (Regulated Sources)

Charges from other sources generated £247m including safety charges (audit, inspection), baggage handling, passenger check-in environmental charges (offsetting carbon emissions), and security charges.

As analyzed from the financial report the business model of London Heathrow Airport has a combined structure of traditional and commercialized models including aeronautical revenue of £1879 Million as well a strong emphasis on non-aeronautical revenue accounts for £564m including the sources of retail and others. The analysis represents that the business model is somewhere between traditional (utility) and commercialized.

Inventory of the London Heathrow Airport

Airfield

Heathrow Airport has a vast area of 1,227 hectares which features two pivotal runways. The northern runway with dimensions of 3,902 meters by 50 meters and the Southern runway measures 3,658 meters by 50 meters. Moreover, the airport infrastructure accommodates 192 aircraft stands, each equipped with air bridges for seamless transition of passengers. There are 97 remote stands for aeronautical activities and 15 specialized cargo stands for cargo operations. Additionally, the retail space of Heathrow spans around 58,600 sqm, accommodating 314 operational outlets for retail, food, and beverage services (Airfield maps | Heathrow,).

Terminals

Heathrow airports incorporate multiple terminals ranging from 2-5 having unique history and features. Starting from Terminal 1 which was closed in 2015 to pave the way for the expansion of Terminal 2. Next, Terminal 2 which was inaugurated by Queen Elizabeth II, spans 40,000 square meters and emphasizes sustainability awareness with 124 solar panels. Terminal 3, with the introduction of the UK’s first moving walkways, started operational in 1961, covering 98,962 square meters. Prince Charles and Princess Diana opened Terminal 4 in 1986 and housed British Airways. Terminal 5, features a 353,020 square meters structure that accommodated 10.5 million passengers in 2021.

Operational KPI

Following the elimination of all travel restrictions in the UK, there was a notable increase in demand, accompanied by increased growth in traffic. In 2022, Heathrow Airport recorded 61.6 million passengers marking a 218% increase from the year 2021.

Ancillary services and products

There are a vast number of facilities that Heathrow Airport provides to its passengers. Some of them include

- Phone and laptop charging: Including the facility of public telephones equipped with cash or digital payments. Pay-as-you-go telephone and rental phones, Power Pole stations with compatible Plugs and USB cables.

- Postal Services: Including the Post boxes for letters and postcards, stamps conveniently purchasable at Smith branches and through coin-operated stamp machines. Moreover, the Mail & Fly facility allows passengers to mail liquids over 100ml and sharp items.

- Meeting rooms: Facility of Drop-in business lounges to have private meetings.

- Multi-faith prayer rooms: Representing six major world faiths. Cash machines at different spots for passenger convenience. Availability of Toilets, showers, and changing places.

Passenger Satisfaction Survey

An independent passenger survey revealed that Heathrow Airport’s performance and provision of facilities against 350 airports, received a 3.97 rating on a scale of 1-5. Which is comparatively higher than its European competitor airports.

Heathrow Airport’s commercial relationships and agreements with its airline customers

To access Heathrow Airport’s commercial relationships and agreements with other airlines, we need to consider factors such as movement charges, noise charges, emission charges, and parking charges. Movement charges are calculated considering Maximum Take Off Weight, Engine NOx Emissions, noise rating, and approach phases for all flights

- Noise charges: levied on each aircraft differentiated according to aircraft types. Helicopters are subject to a fee of £1135.16 while fixed-wing aircraft weighing no more than 16 metric tons face a charge of £2246.05. These fees are imposed to alleviate the noise impact generated by aircraft.

- Night Quota Charges: Any aircraft arriving or departing unscheduled is charged 5 times more than the normal charges

- Emissions Charges: The charge per kg of NOx is calculated on the Aircraft’s Ascertained NOx Emission if it’s fixed over 8,618kg.

- Departure Charges: Based on the destination: £778.36 for Domestic flights, £820.20 for Common Travel Area flights, £1,610.84 for European flights, and £2,745.50 for all other destinations.

- Parking charges: Wide-Bodied Aircraft, there is no fee for the initial 90 minutes, and thereafter, a charge of £61.70 per 15 minutes. For narrow-bodied aircraft, the first 30 minutes incur no charge, with a subsequent fee of £29.38 per 15 minutes or part thereof.

Rule of Conduct for Commercial Airline Agreements:

- Airlines must adhere to defined standards during significant disruptions affecting passengers at Heathrow.

- Airlines have to prioritize passenger welfare when using Heathrow Airport facilities and Services, committing to comply with the Airline Welfare Protocol.

- Airlines need to fulfill obligations under EC261/2004, as mandated by the law of England and Wales, Scotland, and Northern Ireland through the European Union (Withdrawal) Act 2018, subject to potential amendments, re-enactments, or replacements.

Operational and management strategies

Colleagues: Heathrow aims to create an atmosphere guided by values and establish a foundation that prioritizes cultural diversity, environmental awareness, and sustainability as the core principles.

Passengers: It aims to deliver British-style exceptional customer experiences with convenience, personalization, and reassurance that depicts the world’s finest service.

Investors: Heathrow positioned itself as a global infrastructure investment, therefore its objective was to attain a careful balance between risk and reward for the British economy.

UK Communities and Environment: Local, Regional, National: Heathrow’s strategy includes a focus on sustainable growth to build trust with local communities and stakeholders.

Airlines: Providing airlines and consumers with economical, effective, environment-friendly, and trustworthy airport services.

Commercial airport management techniques: The vision of Heathrow Airport is to “give people the best airport services in the world’’ by reducing carbon emissions in the air and achieving carbon neutrality on the ground. Striving for a waste-free airport and sustainable supply chain and improving the quality of life in communities surrounding Heathrow. These factors align with the broader industry trend towards sustainability and social responsibility.

As stated, the vision of Heathrow Airport is to “give people the best airport services in the world’’. The financial data shows that passenger traffic in 2022 trebled to 62 million, as border restrictions were removed after two years of closures which affected the airline market of the UK. Although the rapid increase in passenger volume was challenging for the airport management Heathrow’s operational and management techniques smoothly balanced the demand and supply. This was proven from individual passenger surveys that Heathrow received great feedback in terms of the best airport services in Europe. This shows that the current management and business strategy were efficiently applied and resulted in achieving a great amount of revenue (£2,838m) and passenger satisfaction of 3.97 which is equivalent to Excellent.

Possible Future Challenges and Opportunities

Principle Risks

Heathrow Airport because of its size and complexity, faces security, health, and well-being risks, information security issues, and cyber-attacks, which can disrupt the ongoing airport expansion. Political and economic factors also influence physical and mental health such as the aftermath of COVID, wars in Ukraine, and high living costs. The security threat level in the UK also poses a risk of attack. Failure to overcome these challenges can impose risk to stakeholders, investors, and passengers and on overall business performance. Therefore, the primary focus is to facilitate every individual, prioritize their preferences, and health, and make every journey worthwhile (Strategic risk: The Heathrow experience, 2019).

Opportunities

One of the recent groundbreaking partnerships formed between Heathrow and Hong Kong International Airports to enhance airline operations, service quality, innovation, and environmental performance (Heathrow, 2016). This marks Heathrow’s first such partnership, focusing on joint projects in central airport operations, crisis planning, passenger service, terminal design, and expansion opportunities. Both airports, with similar customer profiles and global carrier networks, aim to leverage each other’s strengths. Despite current constraints, they share ambitious expansion plans that promise economic benefits and job creation. The CEOs of Heathrow and Hong Kong International Airport expressed enthusiasm for the collaboration, anticipating industry-leading improvements for passengers, communities, and the environment.

Heathrow 2.0

- Net Zero in the Air: Heathrow 2.0 aims to achieve a 15% carbon emission reduction by 2030. This will be achieved by implementing measures to cut up 1% in air carbon emissions through the modernization of airspace and up to 8% reduction by the enhancement of conventional aircraft.

- Net Zero on the Ground: Strive for Heathrow buildings and infrastructure to achieve zero carbon status by the mid-2030s. Heathrow 2.0 will strive to minimize the 87% reduction from airport vehicles, 36% reduction in the supply chain, and zero-carbon status from the Heathrow buildings and infrastructure.

- Sustainable Transport: Targeting a minimum of 45% of passengers using public transport, aiming for 57% usage of single occupancy vehicles.

- Emission Reduction and Air Quality: Ensuring the use of biofuels and implementation of Airside Ultra Low Emission Zone

- Nature Conservation: Develop a Nature Positive Plan for Heathrow by 2022, retain the Biodiversity Benchmark Award, and maximize de-icer recovery through the Clean Water Programme.

- Zero Waste Initiatives: Maximize reuse, recycling, and recovery of materials at Heathrow, Aim to decrease unaccounted-for water by 15% compared to 2019.

- Sustainable Supply Chain: Maximize suppliers achieving gold standard against the Balanced Scorecard. Stimulate business opportunities by increasing the proportion of SMEs in the supply chain (from 40%) and the proportion of local SMEs (from 50%).

- Community Engagement: Introduce a new Giving Back Programme in 2022. Set a target in 2022 to increase the number of Heathrow colleagues volunteering hours in local neighborhoods by 2030. Aim to generate at least £6.5 million for the Heathrow Community Trust by 2030.

- Inclusive Employment Practices: Target at least 43% female senior-level colleagues by 2026. Aim for at least 27% Black, Asian, and Minority Ethnic colleagues at senior levels by 2026. Provide 10,000 external jobs, apprenticeships, and early career opportunities. Offer 15,000 experience-of-work days by 2030.

Growth potential of Heathrow Airport

In 2022, 61.1 million passengers passed through its terminals which was 217% more as compared to the previous year. One of the reasons for this remarkable increase was to removal of border restrictions. This increase alone was equivalent to fitting virtually all of Frankfurt’s 2022 passengers into Heathrow Airport. Therefore, the airport has faced capacity constraints and challenges that have led to its expansion. That’s why, it is planning to grow its connectivity with a third runway to the northwest with several new facilities on and off the airfield. Seeing the steady growth the airport is investing in infrastructure to accommodate its capacity and support its growth (Heathrow SP Limited, 2022).

Revenues & Costs Analysis of 2022

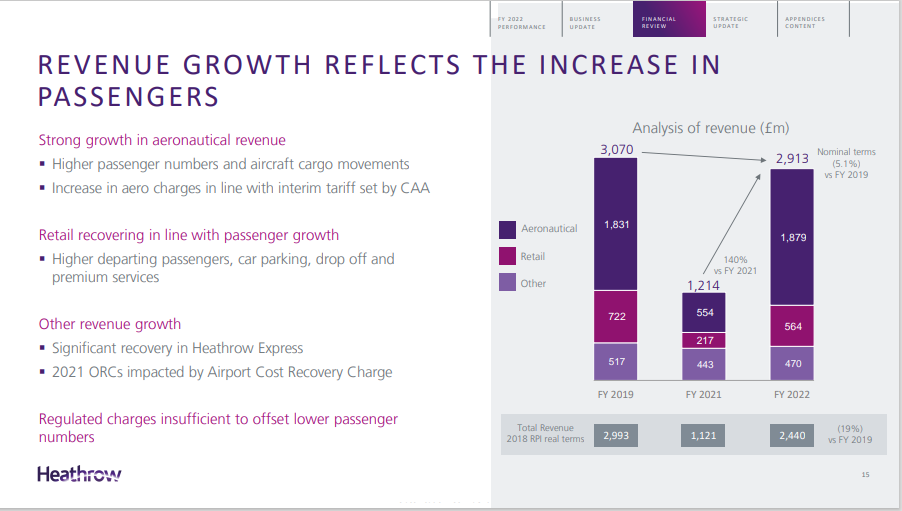

In 2022, Heathrow’s total revenue was £2,913m of which £1,879m was generated from aeronautical and £1,034m from retail and other source.

| Dec 31, 2022 | 2021 £m | 2022 £m | Percentage change |

| Aeronautical | 554 | 1,879 | 239.2 |

| Retail | 217 | 564 | 159.9 |

| Other | 443 | 470 | 6.1 |

| Total | 1,214 | 2,913 | 140.0 |

Aeronautical revenue increased by 239.2%. This is predominantly due to the recovery of passenger traffic following the easing of COVID restrictions and an increase in aero charges. Our maximum allowable yield for 2022 was £30.19 per passenger (2021: £19.36), per the holding price cap set by the CAA for 2022 (Heathrow SP Limited, 2022).

| Dec 31, 2022 | 2021 £m | 2022 £m | Percentage change |

| Retail concessions | 79 | 206 | 160.8 |

| Catering | 21 | 59 | 181 |

| Car parking | 47 | 143 | 204.3 |

| Other retail | 32 | 54 | 68.8 |

| Other services | 38 | 102 | 168.4 |

| Total | 217 | 564 | 159.9 |

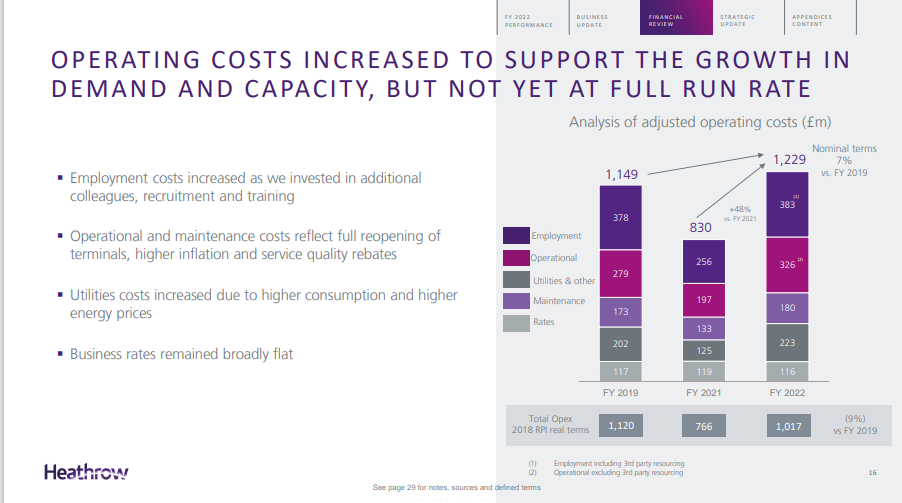

Adjusted operating costs

Adjusted operating costs reached £1,229m (2021: £830m), a 48.1% rise. From £42.80 in 2021 to £19.96 in 2021, adjusted operating costs per passenger dropped by 53.4%. Because of the constant structure of our cost base and the decreased passenger counts from the previous year, the adjusted operating costs per passenger are significantly distorted (Heathrow SP Limited, 2022).

| Dec 31, 2022 | 2021 £m | 2022 £m | Percentage change |

| Employment | 256 | 378 | 47.7 |

| Operational | 197 | 331 | 68.0 |

| Maintenance | 133 | 180 | 35.3 |

| Rates | 119 | 116 | (2.5) |

| Utilities and other | 125 | 224 | 79.2 |

| Total | 830 | 1,229 | 48.1 |

The increase in operations has resulted in a 47.7% increase in employment costs, primarily in Terminals 3 and 4. This covers the price of hiring more employees, working overtime, and providing training and recruitment. Following the termination of the government’s furlough program, we are also paying more on employment-related expenses. Government grants of £21 million were obtained for the entire year ending December 31, 2021, to cover personnel costs associated with staff members who were placed on furlough owing to COVID-19. No comparable payments were received for the entire year ending December 31, 2022, following the scheme’s termination in September 2021. The year-round resumption of operations increased inflation, and service quality rebates offered are the primary causes of the increase in operational and maintenance costs.

The balance between aeronautical and non-aeronautical revenue is important for the airports. Heathrow has been successfully generating non-aeronautical revenues through retail, advertising, and other commercial activities. Heathrow Airport’s growth potential remains robust, driven by its strategic location, hub status, and global connectivity.

SWOT Analysis of Heathrow Airport 2022

SWOT analysis will help identify the internal and external factors that are favorable or unfavorable for achieving the objectives (Heathrow’s strategic brief | Heathrow)

Strengths

- Heathrow is the 3rd largest airport and busiest airport in Europe.

- It has a strategic location and connectivity serving over 200 destinations in 80 countries

- It is investing in infrastructure to improve capacity, operational efficiency, and passenger experience.

Weaknesses

- Airport faces capacity constraints, delays, noise, and air pollution due to limited space.

- Heathrow is subject to strict regulatory and legal requirements.

Opportunities

- Heathrow has the opportunity to increase its capacity and competitiveness by building a third runway.

- It would serve an additional 40 million passengers and 260,000 flights per year by 2030.

- Heathrow 2.0 initiatives that aim to reduce carbon emissions, waste, and noise.

Threats

- Heathrow faces intense competition from other airports.

- Gatwick, Stansted, Luton, Manchester, Dubai, and Amsterdam, offer lower fares, more destinations, and better services.

- Heathrow faces changing customer preferences and expectations, such as increased demand for low-cost travel, personalized services, and digital solutions.

Heathrow Airport’s SWOT analysis reveals a strong market position and strategic advantages, but it also highlights critical challenges. While the airport has opportunities for growth through capacity expansion and environmental initiatives, it must address weaknesses such as capacity constraints and regulatory complexities. Additionally, managing competition and adapting to changing customer preferences will be essential for long-term success.

Key Factors for Growth and Optimization

Heathrow Airport is ranked at the 8th position as the busiest airport in the world(top 10 busiest airports in the world revealed, 2023). The airport has shown a strong recovery in passenger numbers in the summer, reaching 65% of per-pandemic levels by August, with 52.8 million passengers expected for the whole year. It has attributed the recovery to easing travel restrictions and the high booking demand for leisure and business travel. The airport is diversifying its revenue streams and enhancing its customer value proposition by developing new products and services, such as digital solutions, cargo facilities, and airport city projects.

London Heathrow Airport invested in improving its services and reducing its environmental impact, such as launching a cycling and walking plan, a surface access strategy, and a net zero plan. The airport faced some challenges such as long queues and flight cancellations, caused by staff shortages, border controls, and weather disruptions. Heathrow expressed its confidence in the future of air travel, and its commitment to providing a safe, efficient, and sustainable service to its customers.

Modernizing its airspace and ground operations, investing in sustainable aviation fuels, developing robust carbon offsetting methods, and encouraging cleaner aircraft technology. This would also help the airport reduce its environmental impact, improve its performance, and mitigate the risks and uncertainties of the future. This would also help the airport achieve its goal of net zero aviation by 2050, and comply with regulatory and legal requirements.

References

Airfield maps | Heathrow. Heathrow Airport. https://www.heathrow.com/company/team-heathrow/airside/useful-publications/airfield-maps

ANNUAL REPORT. (2022, June). Heathrow: Welcome to Heathrow Airport | Heathrow. https://www.heathrow.com/content/dam/heathrow/web/common/documents/company/investor/reports-and-presentations/annual-accounts/sp/Heathrow_SP_2022_ARA.pdf

Heathrow. (2016, March). Heathrow and Hong Kong International Airport sign world-class partnership. Heathrow Press Releases, Press Packs | Heathrow Media Centre. https://mediacentre.heathrow.com/pressrelease/detail/6087

Heathrow’s strategic brief | Heathrow. Heathrow Airport. https://www.heathrow.com/company/about-heathrow/company-information/heathrows-strategic-brief

Heathrow SP Limited. (2022, December 31). Heathrow: Welcome to Heathrow Airport | Heathrow. https://www.heathrow.com/content/dam/heathrow/web/common/documents/company/investor/reports-and-presentations/financial-results/2022/Heathrow_(SP)_Limited_Q4_2022_Results_Release.pdf

Strategic risk: The Heathrow experience. (2019, September). Chartered Institute of Internal Auditors | iia.org.uk. https://www.iia.org.uk/audit-risk-magazine/features/strategic-risk-the-heathrow-experience/

The top 10 busiest airports in the world revealed. (2023, November 9). ACI World. https://aci.aero/2022/04/11/the-top-10-busiest-airports-in-the-world-revealed/

Heathrow 2.0 sustainability strategy | Heathrow. Heathrow Airport. https://www.heathrow.com/company/about-heathrow/heathrow-2-0-sustainability-strategy

Leave a Reply