Your cart is currently empty!

Dubai International Airport (DXB) Business Strategies

Introduction

This passage highlights the business model of Dubai International Airport (code name: DXB) using financial data, inventory, structure and mapping, capacity, and traffic data. It also highlights the role of management and operations in commercial management techniques. This passage then determines a criterion for measuring/analyzing the success of the DXB airport. Then, some future challenges and opportunities for the airport in discussion are discussed based on the business environment, competition, and increasing regulations.

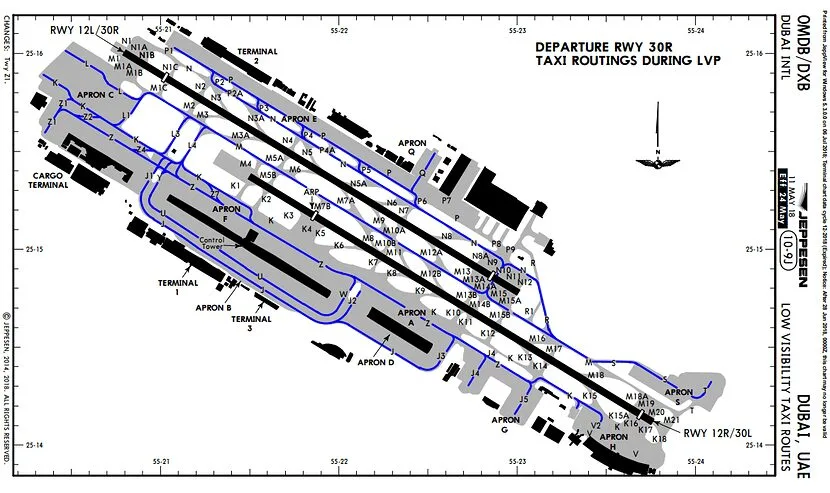

Airport Mapping

Dubai International Airport’s inventory includes the following elements:

- DXB has a perimeter of – 7 KM x 2.5 KM.

- It has two parallel runways:

- RWY 12L/30R

- RWY 12R/30L

- DXB has a total of 4 Terminal Buildings:

- Terminal 1 – It has Concourse “D” and is bound to serve all airlines.

- Terminal 2 – It is bound to serve all scheduled, charter, and special flights including pilgrimage.

- Terminal 3 – It has Concourses “A, B and C” and serves as the hub for Emirates Airlines.

- Terminal 4 – It is the cargo terminal.

- DXB facilitates its passengers through a total of 526 check-in counters.

DXB Commercial Activities

Dubai Airport is a commercial airport established in April 2007 by the Dubai Department of Civil Aviation.

Commercial agreements of DXB include agreements related to landing fees and airport charges, gate leases and slot allocation, fuel agreements, terminal services, and amenities, revenue-sharing models, long-term agreements, and partnerships.

Dubai International Airport charges airlines for landing fees, parking fees, and other services depending upon the size of the aircraft, time of the day, ground handling facilities, etc.

Airlines also lease gates and they are allotted takeoff and landing slots. This affects the airline’s operational efficiency.

Commercial agreements also involve fuel agreements with suppliers. This includes bulk fuel purchases which may lead to cost savings.

To enhance passenger experience airports are into agreements to provide lounges, check-in counters, and within terminal facilities.

Duty-free shops and concessions are essential for assessing the financial relationship.

Agreements such as strategic partnerships and collaborations that include hub operations, code sharing, or joint marketing initiatives are long-term in nature.

DXB Agreements with Airline Customers

To deepen commercial ties, Gulf Air and Emirates have signed a memorandum of understanding which includes code-sharing plans, loyalty benefits, and cargo cooperation plans. Under this agreement, Emirates will place its code EK on Gulf Air flights operating between Bahrain and Dubai. Conversely, Gulf Air will add a GF code to Emirates flights. Under the codeshare agreement, Emirates will integrate its EK code on Gulf Air-operated flights from Bahrain (BAH) and Dubai (DXB), while Gulf Air will add its GF code to Emirates’ services between the destinations (“Gulf air signs Emirates Codeshare, widens Ras al Khaimah agreement,” 2021).

A training collaboration agreement with International Aviation Consulting and Training (IACT) has been signed by Dubai Airports. This agreement marks a significant development in developing the training landscape and English language skills for aviation personnel (“Dubai airports, international aviation consulting and training sign agreement,” 2023).

In November 2023, Emirates announced an agreement with Shell Aviation for the supply of 300,000 gallons of SAF for use at Dubai International Airport (“Emirates and Shell Aviation sign agreement for SAF supply at airline’s Dubai hub,” 2023).

Challenges Faced by DXB

Regulatory compliance challenges faced by DXB because of stringent regulations to adapt to new standards such as security, safety, and environmental sustainability (Priya Chetty, 2019).

Competition is one of the major challenges. Other airports in the Middle East i.e. Hamad International Airport in Doha and Abu Dhabi International Airport are a major competitive force. DXB needs to enhance services to remain a preferred choice of airline.

Capacity management should be done to cope with ever ever-increasing demand for air travel. Investment in new technology is required to stay efficient and competitive and to cope with the evolution of technology (Dubaiprivatetour, 2023).

Economic instabilities also affect travel demands. An airport should be flexible to sustain such fluctuations.

One major challenge being faced by UAE aviation sector is security. Security systems should be integrated at all major airports and work as a single system.

Opportunities for DXB

Long distances between terminals cause difficulty for passengers. This could be improved by providing conveyance or by constructing short routes to facilitate passengers.

Long lineups at immigration and security lead to delays and difficult-to-catch flights. Changes in the process of immigration must be made to enhance customer experience.

DXB has an opportunity to provide an exceptional passenger experience. This can be done by streamlining processes, improving connectivity, and offering innovative services (“Dubai Airports’ Total Quality Management” 2020).

Also, Dubai airport can grow in the cargo industry because of its strategic location. Investing in cargo facilities and services can be a rewarding opportunity.

Operations and management strategy

Operations Strategies

Dubai Airport, a Gulf company controls the operations of Dubai Airport. It provides operation and maintenance of airport terminals, resolving customer complaints, and integration of operational services and management services. The company provides safe, secure, and efficient airports for airline customers and companies.

DXB is a hub airport that connects various regions. This facilitates efficient transfers and preferred stopover points.

Dubai Airport is continuously expanding to cope with ever-increasing demand. It has undergone extensive expansion projects i.e. construction of new terminals, runways, and other facilities.

Management Strategy

- Strategic Partnerships:

- Dubai Airport is in strategic partnership with aviation-related organizations. It has agreements such as code sharing, alliances, joint ventures, etc. to contribute to increased connectivity.

- Diversification:

- Dubai Airport provides services beyond passenger travel i.e. cargo operations, maintenance – repair – overhaul, and retail offerings. This diversification contributes to revenue streams beyond traditional aviation services.

- Adaptation to Market Trends:

- The management of DXB is likely attentive to market trends, i.e. changes in consumer behavior, travel preferences of passengers, and technological advancements. Adaptability to these trends ensures that airports remain competitive.

These strategies are aligned with the Dubai International Airport commercial airport management techniques. It emphasizes on hub and spoke model, continuous expansion of operations, and efficient ground handling operations that are to enhance connectivity and operational efficiency.

The airport is committed to providing cutting-edge technology, diverse services, and strategic partnerships to stay competitive and up to date with the market trends to sustain in the dynamic aviation landscape. By incorporating the above-mentioned strategies, Dubai Airport has portrayed a comprehensive and forward-looking commercial approach that not only aims to meet current demands but also strategically grows in the highly competitive aviation sector.

The Success of Current Business Strategy

For the evaluation of the success of the current business strategy, some key criteria are considered. These may include but are not limited to growth in passenger and cargo traffic, operational efficiency, financial performance, customer satisfaction, and the strength of partnerships and alliances. These are some critical indicators of success. Moreover, the efficient utilization of infrastructure, diversified operations, adoption of innovative technology, commitment to sustainable practices, and airports’ overall competitiveness in the market are essential factors.

Regular assessments of Dubai Airport’s adherence to regulatory standards and its ability to adapt to market trends and contribute to evaluation. Also by analyzing data across these criteria, stakeholders can gain insights into the effectiveness of Dubai Airport strategy to position itself as a leading global hub and meet the evolving needs of the aviation industry.

DXB Evolution Over Time

The official inauguration of Dubai International Airport (DXB) was held on September 30th, 1960. At that time, it only included a compact sand airstrip of 1800 meters, a single fire station, an apron, and a small terminal building.

In the 1990s Dubai started modernizing and expanding DXB and so the airport infrastructure was redeveloped with new terminal buildings, a second runway, and other facilities. Then in 2008, a third terminal building was opened for use.

In the 2010s DXB turned a great point as it emerged as the global aviation hub. Emirates Airlines based at DXB expanded its fleet and route network worldwide, attracting more transit passengers. Dubai also started hosting Air Shows and Economic EXPOs. The airport’s passenger numbers skyrocketed and reached record-breaking figures.

Like everywhere, the Covid-19 pandemic era was a challenge for DXB as well. Reduced passenger numbers, travel restrictions, and flight cancellations negatively impacted the operations of the DXB. However, DXB adhered to SOPs and made it through the tough times gradually.

Future Planning and Expansion

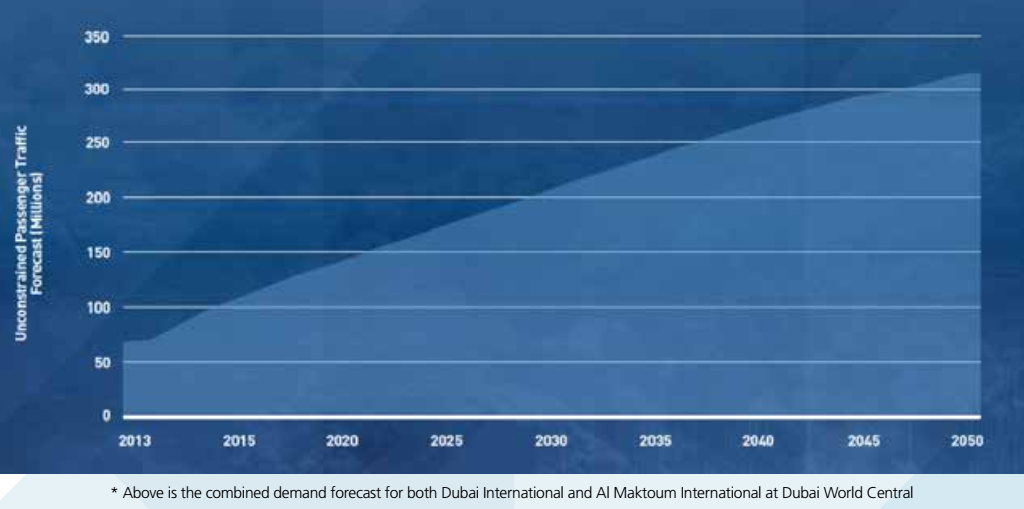

Traffic Predictions to 2050 (in Millions)

Fleet Projections at Terminal 3 (Emirates hub)

- Emirates expects 50 Airbus A350-900s on order to be delivered by 2024.

- Emirates expects 30 Boeing 787-9s on order to be delivered by 2025.

- Emirates expects 115 preordered Boeing 777Xs to be delivered by 2025 (Schlappig, 2023).

Such statistics give a notion that the DXB is nearing traffic saturation and it implies the need for rapid expansion and diversification of the Dubai World Central (DWC) which is nearby Al-Maktoum International Airport. Forecasts related to Dubai Airport suggest passenger demand exceeding 190 million by 2030, 260 million by 2040, and 309 million by 2050. Therefore, both DXB and DWC must be developed for both commercial and utility business practices.

SWOT Analysis of Dubai International Airport

Strengths

- Strategic Location

Dubai and its International Airport DXB naturally hold a strategic geographical location in the entire Middle East and therefore, play a crucial role as a global hub of aviation. It is centrally located in Asia, Europe, and Africa thus providing excellent services for international passengers and airlines, such as refueling stops.

- Top-Notch Infrastructure

The infrastructure at DXB is state-of-the-art due to its modern terminals, advanced facilities, high-tech amenities, and excellent route network. Such conditions are detrimental to a seamless and comfortable travel experience for dynamic air travelers.

- Airline Connectivity

DXB is a hub airport of the world’s leading airlines in both LCC and Legacy business categories, Flydubai and Emirates respectively. This exhibits DXB’s prominence as a key transit point during global routes and passengers from all over the world are subject to hosting by DXB.

- Diverse Routes and Airlines

Due to its central location, it is safe to interpret DXB as an airport that serves a wide array of international airlines. Hence, multiple feasible options are available for passengers to fly with. Also, airlines from different continents often tend to code-sharing and interlining agreements to satisfy demand and supply. DXB is located in the transitioning area for such agreements.

- Business and Leisure Facilities

DXB is famous for its luxurious offerings such as business lounges, expensive outlets, dining and food options, entertainment facilities, and catering to both business and leisure passengers.

Weaknesses

- Congestion

High passenger traffic volume favors growth but often causes overcrowding. Such conditions can sometimes cause inconvenience for the passengers due to longer queues and wait times.

- Limited space for Expansion

DXB relatively operates in a confined space making it challenging for the management to expand and accommodate the growing passenger volume. Hence, it can accommodate expansion and growth up to a certain level.

- Dependence on the Aviation Industry:

DXB’s revenue heavily relies on aviation operations making it sensitive to the fluctuations in global economies and travel demand and other unforeseen events such as pandemics or geopolitical events.

Opportunities

- Tourism Growth

Dubai is increasing in popularity as a tourist and commercial destination, and it is appealing to all types of travelers. Moreover, Dubai is also developing itself as a business and leisure hub to attract more and more audiences.

- Infrastructure Development

Investments in additional terminals, upgraded facilities, and technological advancements can boost capacity and efficiency leading to a better passenger experience and ultimately reducing congestion.

- Expansion of Air Routes

Opening new routes and partnerships with more airlines can further expand DXB’s global connectivity. This shall further attract the transitioning passengers and boost revenues.

Threats

- Competing Regional Airports

Nearby airports in the region are Abu Dhabi International Airport and Doha’s Hammad International Airport. These pose a competitive threat contending for passengers and business partnerships.

- Technological Disruption

Rapid advancements in technology, such as the induction of supersonic jets can significantly deter the demand for transit, and air travel patterns may also change due to the global shift toward virtual business models.

DXB Non-Aeronautical Revenues

Although major revenue streams for DXB are aeronautical operations yet commercial activities at DXB are significant enough to claim that DXB uses a mixed approach in modelling its revenue streams, commercial and traditional business model.

The DXB Duty-Free records average data of yearly retail sales and jots them down as 2.9 million bottles of perfume, 2066 tonnes of chocolate, 995 tonnes of dates, and 2711 kilograms of gold sold1.

- Retail and Commercial Activities

Non-aeronautical revenues from commercial activities might continue to incline significantly over the coming years. This is due to enhanced tourism growth, Future City, Expos, and other international events.

- Advertising and Sponsorships

Revenues generated from advertising spaces within the airport, sponsorships, and partnerships with brands could increase considerably and hence, attract larger and diverse retail sales.

- Services and Ancillary Revenues

DXB as a Hub opens doors for various services such as lounge access, hotel accommodations, car rentals, and ground transportation. If there is an expansion plan, then certainly these offerings will continue to improve meanwhile expediting the passenger base.

Resulting Passenger Experience

It is safe to state that the DXB is far from replicating the business approaches used today, it rather focuses on establishing strategic partnerships with key customers and stakeholders and has put the passenger experience at the heart of the design of facilities, processes, and services. For such purposes, community processes and vendor systems have been developed and are projected to expand so that a customer-centric airport experience may easily be realized.

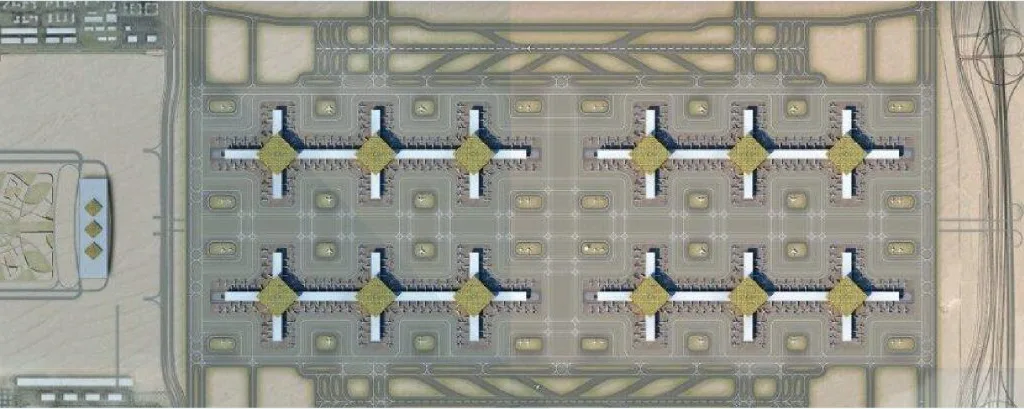

The Airport of the Future

The new and modern layout takes the form of a modular design consisting of adjacent triple plus-shaped concourses. This shall optimize passenger convenience and movement. Each of the concourses shall comprise 100 contact stands compatible with the planned fleet for the future (“Why Dubai airports,”).

Each concourse shall comprise 3 nodes connected by multimodal ground transportation facilities. The transportation vehicles shall be connected near entry and exit points to minimize mobility time (“Dubai Hints Ambitious Plans for New ‘Airport of the Future’ in 2030,” 2023).

Inside each concourse, shall be strategically placed, duty-free shops such as demonstrated below:

References

Dubai airports’ total quality management – 2759 words | Report example. (2020, August 1). IvyPanda. https://ivypanda.com/essays/dubai-airports-total-quality-management/

Dubai airports, international aviation consulting, and training sign an agreement. (2023, November 23). ZAWYA – Your trusted source for business and finance news. https://www.zawya.com/en/business/aviation/dubai-airports-international-aviation-consulting-and-training-sign-agreement-vyh7r5tt

Dubai hints ambitious plans for new ‘Airport of the future’ in 2030. (2023, November 21). Business Traveler USA. https://businesstravelerusa.com/news/new-mega-airport-dubai/

Dubaiprivatetour. (2023, February 24). What are the challenges in transfer at Dubai International Airport? Blog. https://www.dubaiprivatetour.com/blog/what-are-the-challenges-in-transfer-at-dubai-international-airport/

Emirates and shell aviation sign agreement for SAF supply at airline’s Dubai hub. (2023, October 2). Emirates and Shell Aviation sign agreement for SAF supply at airline’s Dubai hub. https://www.emirates.com/media-centre/emirates-and-shell-aviation-sign-agreement-for-saf-supply-at-airlines-dubai-hub/

Fact Files. https://media.dubaiairports.ae/fact-files/

Gulf air signs Emirates Codeshare, widens Ras al Khaimah agreement. (2021, November 15). Aviation Week Networkpage | Aviation Week Network. https://aviationweek.com/air-transport/airports-networks/gulf-air-signs-emirates-codeshare-widens-ras-al-khaimah-agreement

Priya Chetty. (2019). Airport security challenges faced in the UAE. projectguru.in. https://www.projectguru.in/airport-security-challenges-faced-in-the-uae/

Schlappig, B. (2023, November 14). Emirates’ first & business class plans for new fleet. One Mile at a Time. https://onemileatatime.com/insights/emirates-first-business-class-new-fleet/

Why Dubai airports. (n.d.). Dubai Airports. https://careers.dubaiairports.ae/working-for-dubai-airports/#section1

https://c.ekstatic.net/ecl/documents/annual-report/2021-2022.pdf

Similar Post

Comments

2 responses to “Dubai International Airport (DXB) Business Strategies”

-

[…] Read More About: Dubai International Airport (DXB) Business Strategies […]

-

[…] Related: Dubai International Airport (DXB) Business Strategies […]

Leave a Reply